AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. Company 2 will record the sale as due from account and Company 1 will record the purchase in the due to account as they have yet to pay Company 2.

Simple Assessments The Effect On Self Assessment Tax Returns Business Infographic Self Assessment Tax Return

Company 1 purchases goods from Company 2 on account credit.

. The board of directors for Unreal corp. This is because the company has already serviced this order in terms of processing the relevant goods and services. Under the accrual method of accounting the above transaction will be.

Amount due to Director But im not sure how to do it in QB. DLA is an account on the company financial records that reports all transactions between the director and the company. For the fiscal year ended December 31 2016 Alpha Company had credits sales that amounted to 300000.

Shareholders of a company do not owe the same duties and responsibilities to the company that a director does. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding amount and Average Lending Rate ALR by Bank Negara Malaysia BNM and disclose it in your Audited Financial Statements as Interest Income and. Credit card sales on July 8 2016 amounted to 12000 and were subject to a 25 bank feeUse this information to.

The amount that is due from customers is also referred to as Accounts Receivable. The due to is used in conjunction with a. But on 1 October 2019 he obtained RM 30000 in interest-free director loan from the company.

Generally directors do not have any right to be remunerated for the directorial services they perform for the company. Directors fees are fees to be paid to a director in their capacity as company director for the directorial services they perform for the company. AMOUNT DUE TO DIRECTOR Date Journal Type 01-01-0001 Ref.

Textbook Solutions Expert Tutors Earn. CASA FOREST BIO WOOD MANUFACTURING SDN. The balance of due to a director represents the amount due to a director of CTGH for his loans to CTGH.

A liability account typically found inside the general ledger that indicates the amount of funds currently payable to another account. View Amount due from directorpdf from ACCOUNTING BBSA4103 at Open University Malaysia. Whether a loan from the company to a shareholder is permissible and on what terms is dependent on the decision of the board of directors.

When the shareholder pays back the loan cash is increased and Due from Shareholder is decreased or set to zero depending on the amount of money paid back. The due from account is typically used in. DEFERRED TAXATION The annexed notes form an integral part of these financial statements.

Soon Soon obtained director loan of RM 150000 on 1 April 2019 where the interest rate of the director loan from the company is fixed at 5 a year where it is due at the end of the month. If we run a payroll for you of say 125000 gross equating to 100000 net which you should pay yourself the 100000 salary due creates a credit in the Director Loan AccountDLA until such time that your company pays yourself the salary to show that the company still owes you as the director 1000. In the books of Unreal Corp.

Director has made paymentsettlement to Supplier using his own personal bank account. Credit that is due from customers is considered to be a current asset. AMOUNT DUE TO DIRECTOR SHRAN AMOUNT DUE TO DIRECTOR SHRAN INV032017 BANK from ACCOUNTING 201311153 at Adamson University.

The Due from Shareholder receivable account may be paid within one year or it could carry a balance for a significantly longer amount of time. Accounting entry should be. Due to this there are no legal restrictions concerning loans from the company to a shareholder.

Historically 25 of credit sales are uncollectibleAlpha Company uses the percentage of sales. Due From Account. Approved a payment package of 100000 per month including the bonus for one of its directors.

This is the representation of the debtors that the company has at a given. The amount needs to be paid back in 15 days. 1 Home DR Home CR Home Balance BALANCE.

DUE TO A DIRECTOR. However if a company wishes to pay directors fees to its directors. Supplier Expenses Credit.

Show accounting and journal entry for directors remuneration at the end of the year if the payment is done via cheque. AMOUNT DUE FROM DIRECTOR - TAX IMPLICATION IN MALAYSIA. Amounts due to the director from the company should be recorded in the companys books as a creditor while the amounts due from the director to the company should be recorded as a debtor.

1100628-TIncorporated in Malaysia 14 NOTES TO THE FINANCIAL. A due from account is an asset account in the general ledger that indicates the amount of deposits currently held at another company. The amount due is unsecured interest free and has no.

Due To Account. He repaid RM 60000 to Krunch Sdn Bhd on 1 May 2019.

Universal Fidelity Consumer Complaint February 12 2013

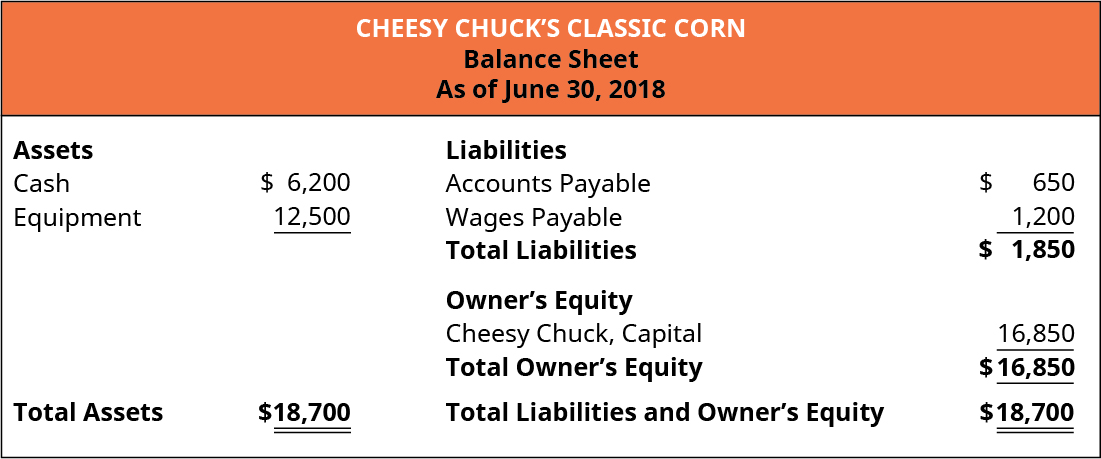

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

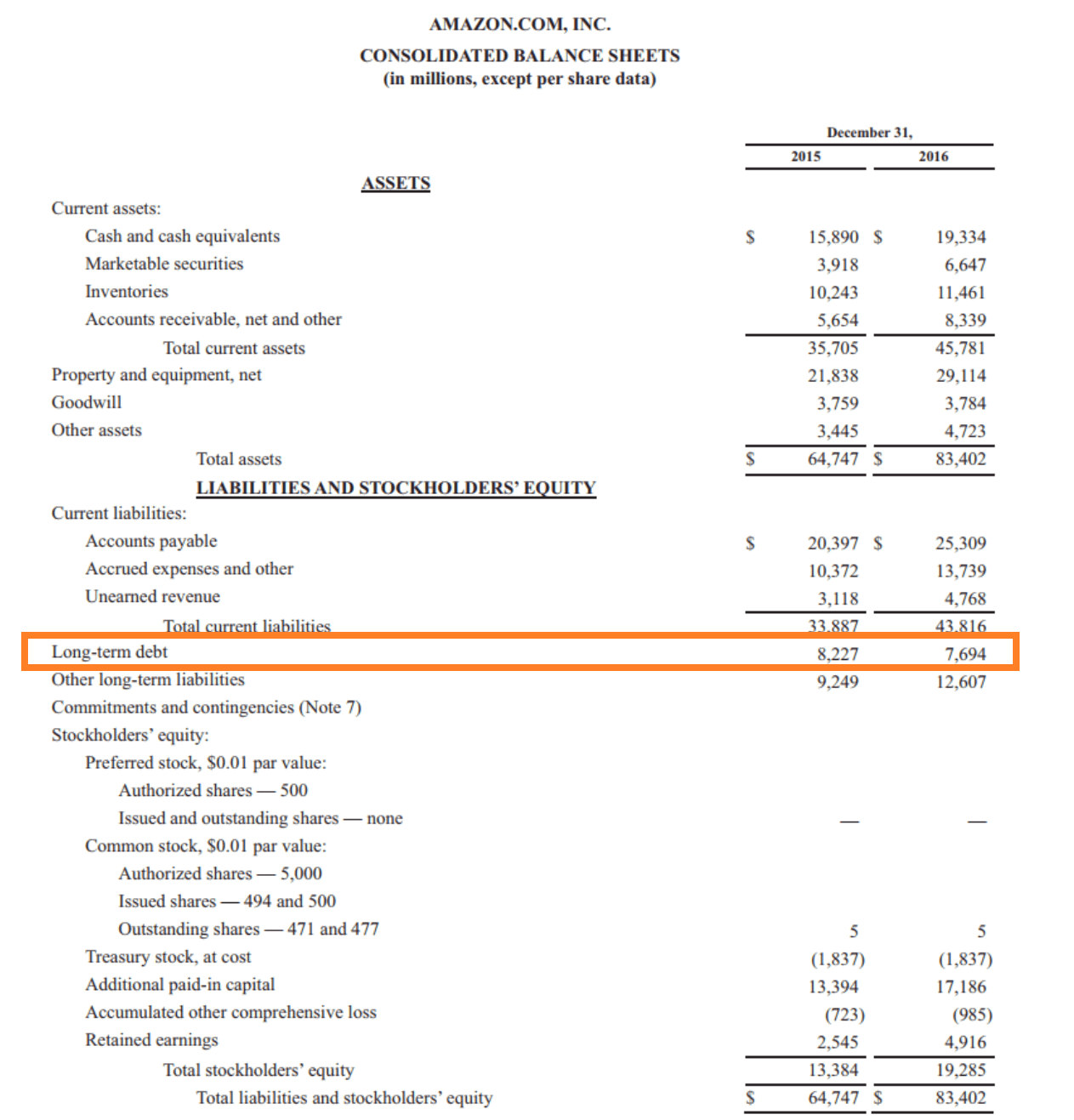

Long Term Debt Definition Guide How To Model Ltd

Notice From Gst Department Top Reasons Response Timing Eztax In

What Are Long Term Liabilities Bdc Ca

Mse And Which Plea With Fca Not To Add Ppi Deadline For Ppi Claim Letter Template For Credit Card Cumed Org

Usa Meituan Invoice Template In Word And Pdf Format Fully Editable

Freelance Video Editing Contract Template New Sample Freelance Contract Templates Pages Word Doc Freelance Graphic Design Contract Template Free Graphic Design

5 Sample Chef Invoice Templates

:max_bytes(150000):strip_icc()/Clipboard01-1095385694ff4af0bc51b6410f68b5fe.jpg)

What Are Examples Of Current Liabilities

Usa Ups Invoice Template In Word And Pdf Format Fully Editable Gotempl Templates With Design Service In 2022 Invoice Template Templates Words

Untitled Wholeness Tenders Bid

Labor Work Agreement Templates 14 Free Word Excel Pdf Formats Samples Examples Designs

Easy Guide To Msme Form 1 Mca With Filing Procedure Due Dates Sag Infotech Enterprise Development Business Software Small And Medium Enterprises

Free Freelancer Invoice Template Figma Titanui

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)